DeFi Yield:

Get Real

Untangled builds and operates risk oracles and on-chain credit investment infrastructure. We research and advise on DeFi risk management, focusing on market-neutral yield and credit strategies that combine both RWA and crypto-natives.

Proven expertise

Superior risk

We build and execute yield strategies through our in-house credit investment management,

risk modelling and smart contract capabilities

risk modelling and smart contract capabilities

Proven credit strategies

Backed by Fasanara Capital, a leading institutional asset manager and a fintech investing pioneer, we specialise in creating on-chain credit and delta-neutral yield strategies involving both RWAs and crypto natives.

Superior risk monitoring

We transform data on risk, security and protocol incentives, using both quantitative and qualitative methods, into powerful analytics, real-time monitoring and risk oracles, delivering custom risk data and reserve validation via zero-knowledge proof.

Robust credit infrastructure

We designed and built Untangled Pool, a tokenized private credits platform and Untangled Vault, a non-custodial, automated portfolio management tool for DAO treasuries and institutions.

Risk-first credit strategies

Bridge RWAs to DAO treasuries and bluechip crypto yields to institutions

Credit strategies

Impact

Yield

We work with DAO treasuries and institutions to construct and execute non-custodial credit and yield strategies that safely incorporate both RWAs and bluechip crypto natives to suit investors' risk/return appetite.

Risk oracle

Risk modeling

Growth

We help leading DeFi protocols to onboard new collaterals (especially RWAs), simulate risk parameters, provide real-time monitoring and risk oracle leveraging both quantitative and qualitative methods and zero-knowledge proof.

Real yield, world impact

Our private credit tokenization strategies covers assets sourced from a pool of 100+ fintech lenders in 60+ countries providing diversification, yield and impact to DeFi

How it works

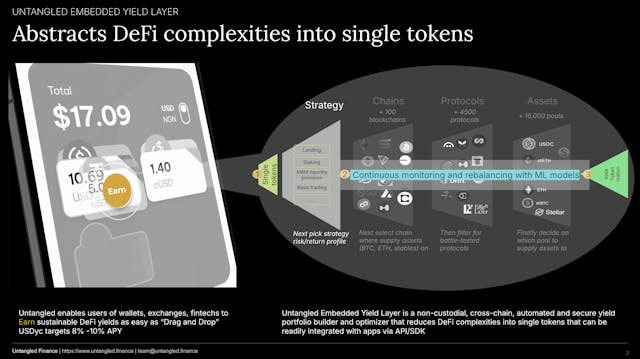

Complementary credit infrastructure solutions: Untangled Pool, Vault and Credio

1

2

3

Untangled Pool

Tokenization platform focusing on private credits: Short-term assets such as working capital for SMEs or trade finance are tokenized into NFTs, providing collateral backing in a transparent manner.

Investors hold a unitranche, JOT or a senior tranche SOT, according to their risk appetite.

Investors hold a unitranche, JOT or a senior tranche SOT, according to their risk appetite.

Providingliquidity

Investors can choose between two types of exposures to credit pools

Private Credit Pools

High Yield

Uncorrelated RWAs

Asset-backed credit solutions - curated and co-invested by Fasanara, a FCA-regulated asset manager

Robust legal structure - tokenized private credits issued by a bankruptcy remote SPV in Luxembourg

Proof of reserve - reserve attestation and asset-level performance tracking delivered through Credio

Yield Strategies Vaults

Institution

DAO treasury

Non-custodial - portfolio allocation by risk/return appetite of DAOs or institutional investors.

Liquid - focus on treasury management, stablecoins and tokenized Money Market Funds

Automated - with Credio, real-time risk management delivered through zero-knowledge proof.

Crafting bespoke strategies

Untangled Vault allows institutions and DAOs to create sophisticated investing strategies.

Diversification

Invest in any blue chip protocols, crypto native or RWAs, across all EVM chains

Liquidity

Set and automatic rebalance liquidity positions to meet DAO's liabilities

Return

Enhance returns through crypto-native or directly sourced RWA opportunities

Home of Institutional DeFi

Introducing the DeFi ‘mullet’

Compliant, Scaleable Front-end

Compliant

Familiar, compliant front-end (AML, KYC and investor accreditation).

Protected

Strong lender protection through recognised legal structure and jurisdiction.

Familiar

Earn yields through well-understood RWAs while gaining exposure to wider DeFi.

DeFi Back-end

Efficient

Reduce costs or create new products and services based on a new financial rail.

Composable

Composable with the rest of DeFi and interoperable cross-chain.

Transparent

Leverage the efficiency, transparency and automation of DeFi .

News and Insights

We are a mission-driven, physically distributed team.

Join us to build the future of global credit investments